how to calculate a stock's price

NurPhoto via Getty Images. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Distance Formula Chilimath Distance Formula Midpoint Formula Math Videos

Last 12-months earnings per share.

. Type in terms. Dividends are expected to be 300 per share Div. This will give you the average price per stock.

Said the central bank in a circular on Thursday. Tesla shares were up less than 1 in extended trading. Pull up a web browser and hop onto a search engine.

If a stock costs 100 but is believed to be worth 90 then it is overvalued in some peoples view. You can learn how to find share price from balance sheets. Calculating Todays Stock Prices.

Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate. Bangladesh Bank has allowed the banks to calculate their stock market exposures at cost prices instead of market prices of the shares. Learn More About American Funds Objective-Based Approach to Investing.

Price of Stock A is currently 10000 per share or P0. Sum the amount invested and shares bought columns. Then locate the closing prices of the previous 2 days or a 2-day period in the past if youre trying to review and evaluate a stocks performance6.

I really only need end of day data but Ive tried numerous endpoints read through the docs etc. Find the closing prices in the data. Why Stock Average Calculator.

Then please enter the input box as asked in the calculator and calculate it by clicking the calculate button. The effective date of the split was not announced. From now on a bank can calculate its stock market exposure at cost prices instead of the market prices of shares corporate bonds and mutual funds.

The p e equals the price of a share of stock divided by the companys earnings per share. 15 hours agoTheir website shows the percent change in example images on the home page so it seems like it should be possible. Keep in mind that this calculation is just a general guideline.

1Look up an online stock calculator. Annual Dividends per share. This can help you learn how to calculate stock prices in real-time.

Stocks profit Net proceeds Costs. Stock price price-to-earnings ratio earnings per share. Market cap aka market capitalization the PE ratio and other Multiples dividends and free cash flow.

Book Value per Share. 2Locate the stocks closing price for a 2-day period. In this case the closing price will be calculated by dividing the total product 1872 by the total quantity traded.

Therefore our capital gain is expected to be 10500 - 10000 or. You can also figure out the average purchase price for each investment by dividing. The price of Stock A is expected to be 10500 per share in one years time P1.

Cumulative returns Stocks profit Costs 100. Suppose you bought Reliance stocks at some price expecting that it will move upwards. 56 as per the last trade.

Consider the actual performance of the stock over a period as though you had invested in it on that first day of the period. The actual prices of stocks can vary significantly from day to day so it is important to. C S t N d 1 K e r t N d 2 where.

Additionally look at how the stock has done year to date YTD as. The decision to buy sell or hold is based on whether an investor or investment professional believes that the stock is undervalued overvalued or correctly valued. Enter your purchase price for each buy to get your average stock price.

To calculate the average price of stock simply add up the price of all the stocks that you have invested in and divide by the number of stocks. C Call option price S Current stock or other underlying price K. How to Calculate share value Example.

Price to earnings ratio or p e is a way to value a company by comparing the price of a stock to its earnings. D 1 l n S t K r σ v 2 2 t σ s t and d 2 d 1 σ s t where. If it is believed to be worth 110 then it is considered undervalued.

Firstly you should know the number of stocks you bought and the price per stock you brought. Starbucks SBUX 02 fiscal year 2021 ended October 3 2021 Starbucks stock NASDAQ NDAQ -11. Low or high p e ratios arent inherently good or bad.

Now its time to calculate stocks profit using the following formula. Every publicly-traded company when its shares are issued is given a price an assignment of their value that ideally reflects the value of the company itselfThe price of a stock will go up and down in relation to a number of different factors. SBUX the worlds leading roaster marketer and retailer.

The term stock price refers to the current price that a share of stock is trading for on the market. Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Powerful Platforms Built for Traders by Traders.

It tells you how much you are paying for each dollar of earnings. What is Stock Price. 14 hours agoThe stock closed at 92590 up by 371 040 on Aug.

Finally calculate the cumulative return on your investment using the formula. These are the steps to calculate stocks profit with ease and accuracy. If the user wants to average down the price of more than two stock prices then the user can add more sections.

This will give you a price of 667 rounded to the nearest penny. Stock Average Calculator helps you to calculate the average share price you paid for a stock. The closing price of stock A in the above example is not Rs.

You will need the corporations total stockholder equity holdings to calculate the total common stockholders equity dividing that number by outstanding common stock value. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. Im not very versed in Stock Market stuff so it may entirely be my ignorance here.

We can rearrange the equation to give us a companys stock price giving us this formula to work with. What Is P E Ratio. In this case the adjusted closing price calculation will be 20 1 21.

Customizable Tools for Your Strategy. Divide the total amount invested by the total shares bought. In this article were going to explore how to calculate stock price using a variety of ways including from.

Im just stuck any help is greatly appreciated.

Step 1 Set A Clear Goal And Compound To It

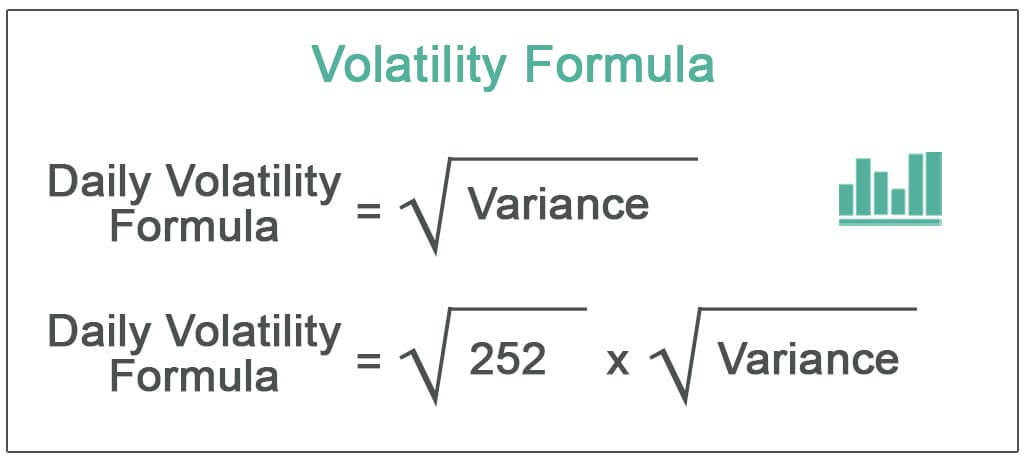

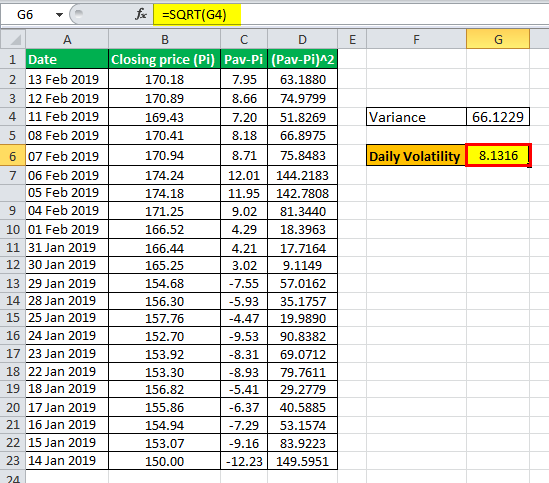

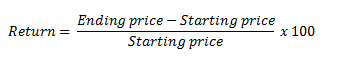

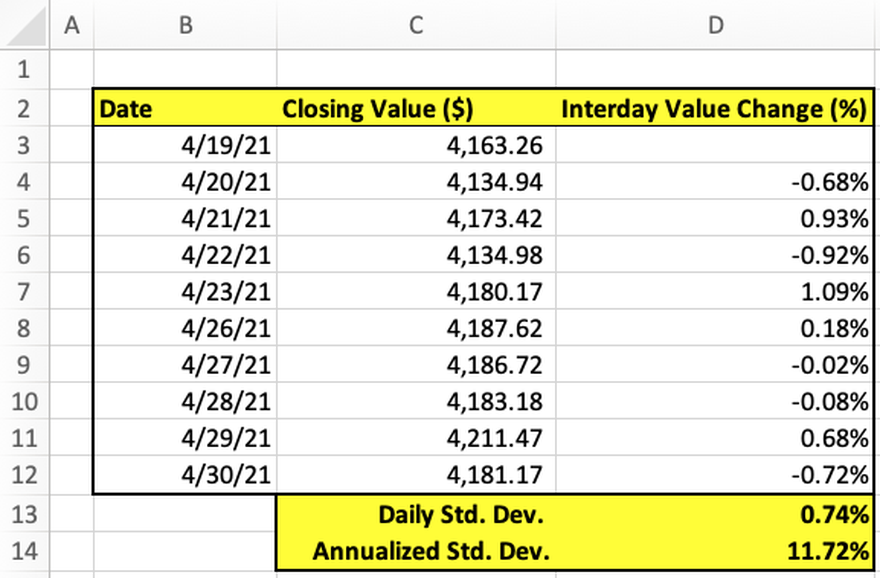

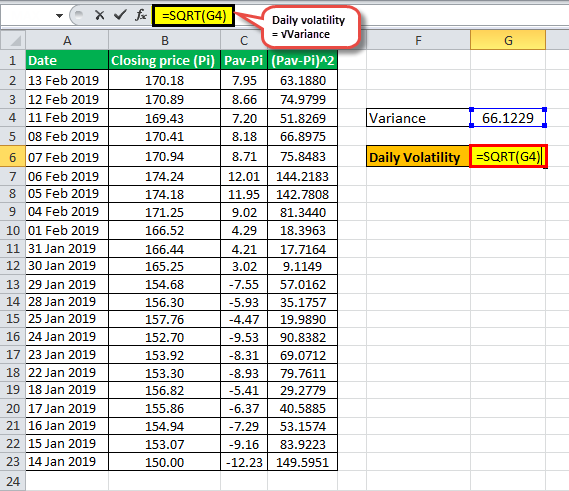

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

What Is Stock Beta And How To Calculate Stock Beta In Python

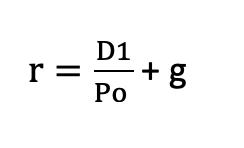

Cost Of Common Stock Formula Accountinguide

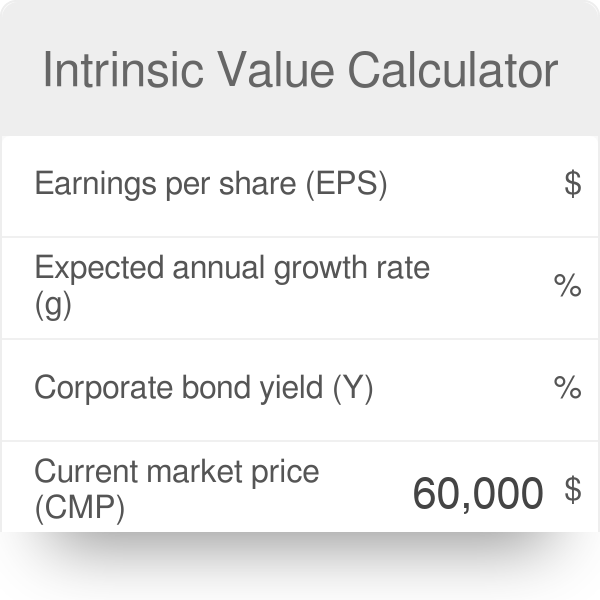

How To Calculate Intrinsic Value Formula Calculator Updated 2022

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

Lookup Historical Stock Split Data For Specific Stocks Starbucks Stock Company Names First Site

Quarterly Average Balance Meaning Calculation Average Meant To Be Balance

How To Calculate Stock Correlation Coefficient 12 Steps

The 4 Basic Elements Of Stock Value Marketing Metrics Fundamental Analysis Stock Market

How To Use Excel To Simulate Stock Prices

How To Calculate Return On Indices In A Stock Market The Motley Fool

Stock Investment Calculator Calculate Dividend Growth Model Err Investing Online Stock Investing Money

How To Calculate Stock Correlation Coefficient 12 Steps

How To Calculate Volatility Of A Stock Or Index In Excel

Volatility Formula How To Calculate Daily Annualized Volatility In Excel

The Black Scholes Model Explained Trade Options With Me

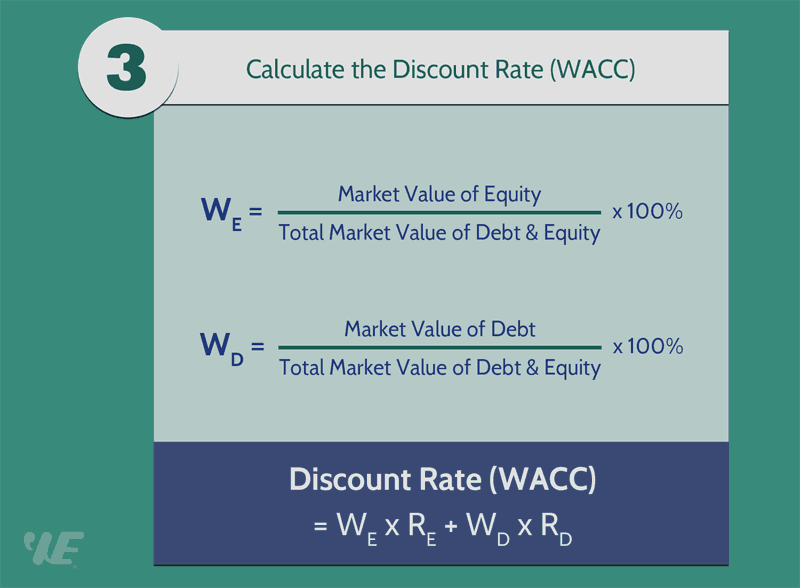

Discounted Cash Flow Dcf How To Use It For Stock Valuation Getmoneyrich